Memuat Plomia.com_

Daftar

[email protected]

WA (+62) 8777-500-1000

Panduan Penggunaan

# Akuntansi Plomia

S&K Penggunaan

[email protected]

WA (+62) 8777-500-1000

Panduan Penggunaan

# Akuntansi Plomia

S&K Penggunaan

Bisnis Selalu Terkontrol dengan Laporan Keuangan Mudah & Instan! Dirancang bagi bisnis/organisasi skala menengah yang hendak mempertahankan kontrol tanpa ribet: cukup spreadsheet (Excel, Google Sheet, dll.) + upload—tanpa instalasi!

Operasional berjalan tanpa laporan terstandar minim kontrol keuangan

Selalu sibuk dan bingung mendekati lapor SPT Pajak

Ragu terhadap kredibilitas pengambilan keputusan

Selalu sibuk dan bingung mendekati lapor SPT Pajak

Ragu terhadap kredibilitas pengambilan keputusan

Selalu cerminkan kondisi keuangan terbaru, rapi, dan konsisten agar bisa bebas dari persoalan di atas bersama sistem pelaporan keuangan cerdas Plomia (±5 MENIT SELESAI!)

Menjaga Kontrol bisnis dan organisasi terhadap karyawan, pelanggan, investor, publik, hingga kreditur/bank, memerlukan dasar yang konkret. Laporan keuangan yang rapi dan terupdate dapat membantu mewujudkan pengambilan keputusan rasional yang tepat sasaran dan dapat dipertanggungjawabkan kepada seluruh pihak yang berkepentingan (stakeholders). Matangkan keputusanmu dengan data keuangan yang JELAS

didukung aplikasi akuntansi Plomia, Mempermudah, Instan!

Pekerjaan 1-2 minggu bisa selesai dalam 1 jam?

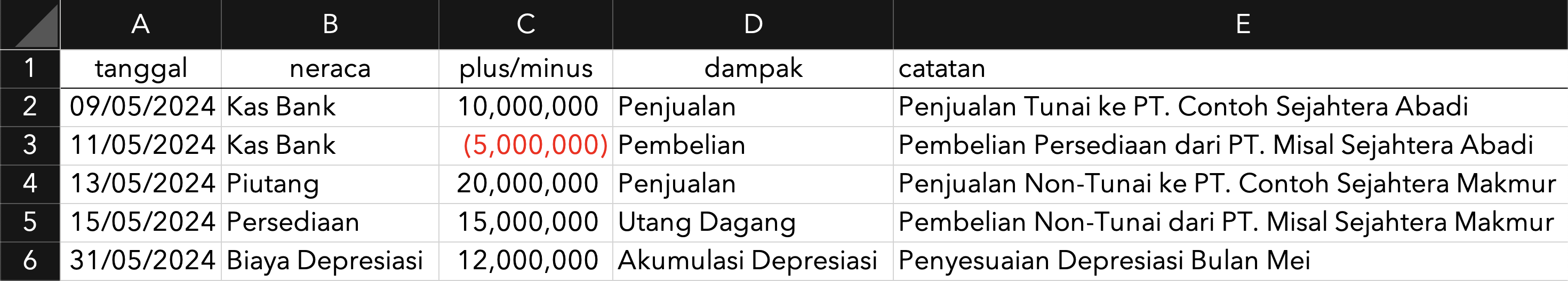

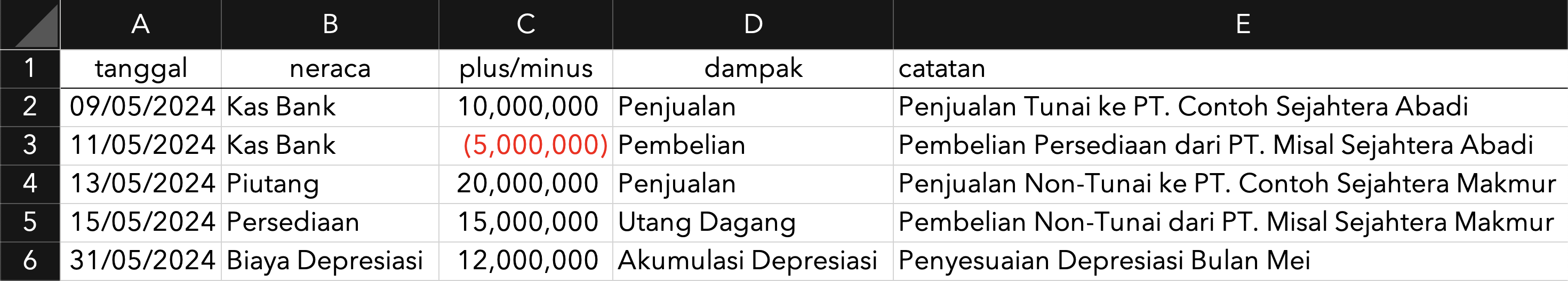

Tanpa mengganggu sistem yang sudah berjalan - Hanya perlu tabel rekapitulasi transaksi:

Detail Cara Pakai Plomia

Coba Gratis Sekarang

Tanpa mengganggu sistem yang sudah berjalan - Hanya perlu tabel rekapitulasi transaksi:

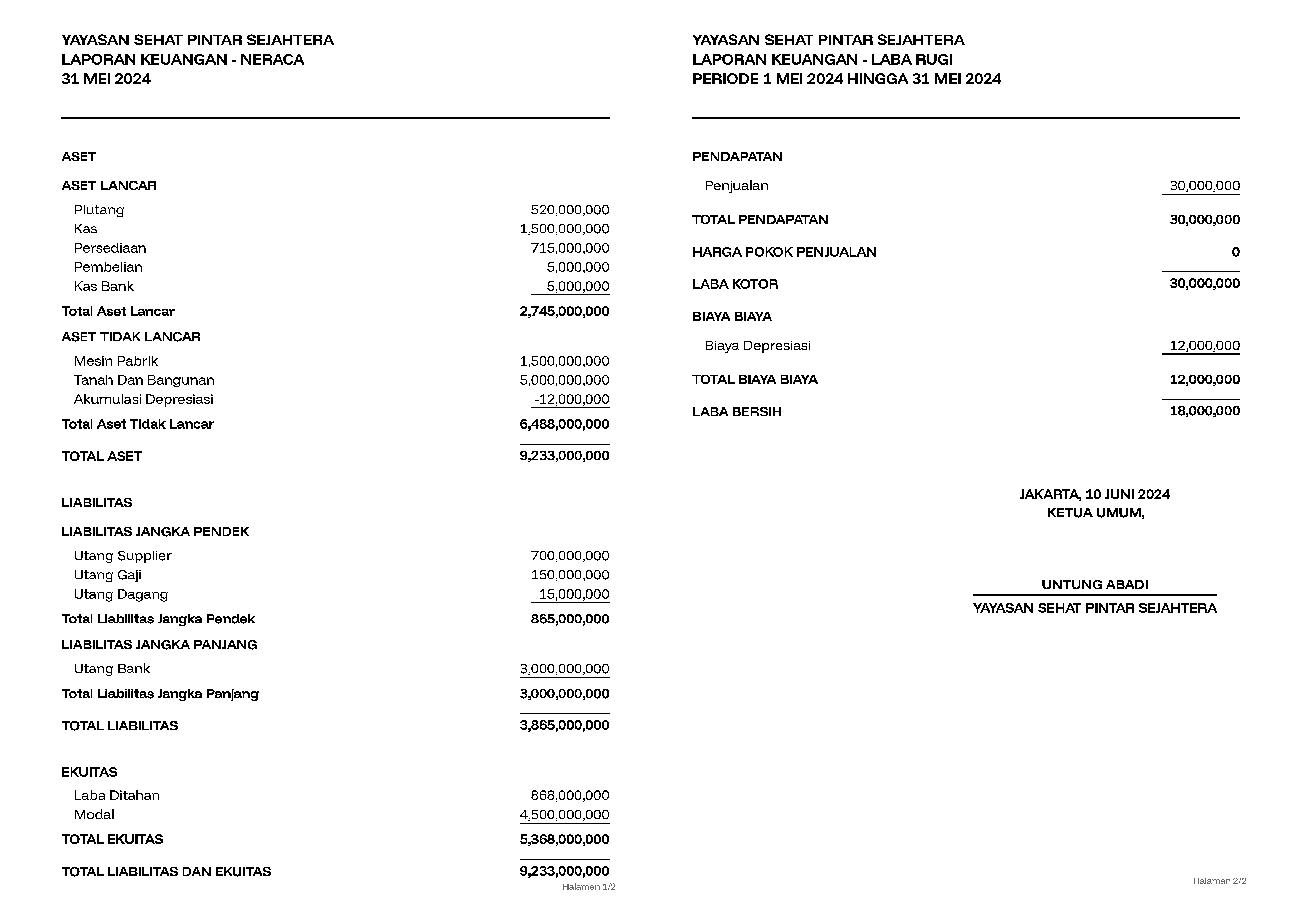

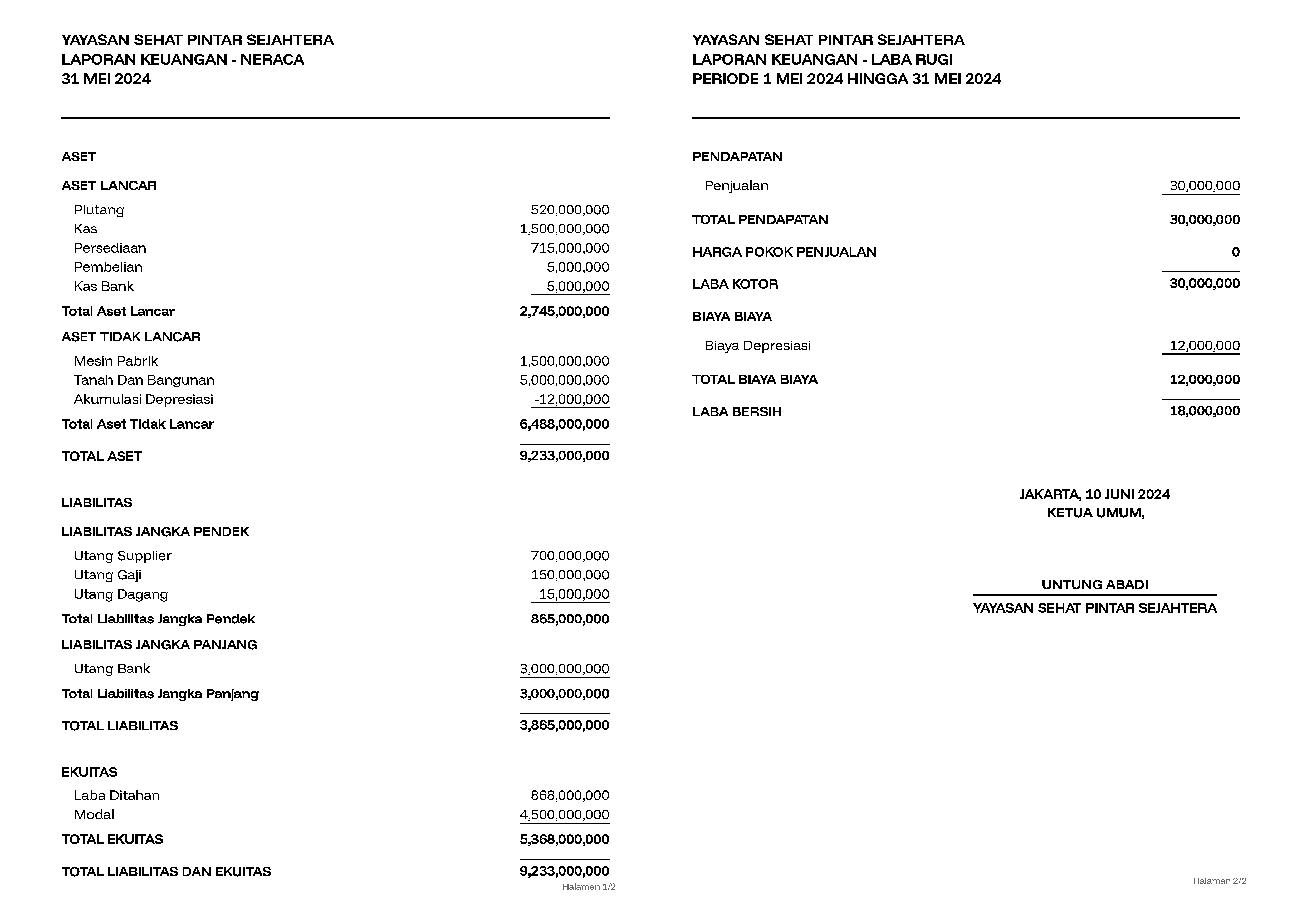

Mengubah tabel di atas menjadi laporan keuangan di bawah secara instan—tinggal upload!

Membership Simple, Fitur Melimpah—Bisnis Jadi Lebih Terkontrol!

Coba Gratis Sekarang! WhatsApp Plomia

-85%

beban kerja administrasi keuangan dengan klasifikasi otomatis dan background uploader. 3ribu

unggahan transaksi setiap bulan untuk Member Premium

(mulai dari hanya Rp 1.650.000/3 bulan!)

30 unggahan bulanan untuk Member Gratis. 9+

pengaturan laporan keuangan agar bisa cocok dengan SAK EMKM (fleksibilitas nama, periode, unduh XLSX/PDF, index catatan laporan keuangan, penandatangan, ubah/tambah instan nama, posisi sub/account, undo, dll.) 10x

lapisan keamanan: autentikasi hash, enkripsi, SSL+HSTS, Cloudflare, CSRF, captcha, firewall, pemisahan arsitektur front-back, proteksi brute force, email alert. <5

menit rata-rata pengguna sudah dapat melihat dan menganalisis hasil jadi laporan keuangannya (output) secara daring maupun dalam bentuk unduhan dokumen XLSX atau PDF yang tersedia bagi Member Premium.

beban kerja administrasi keuangan dengan klasifikasi otomatis dan background uploader. 3ribu

unggahan transaksi setiap bulan untuk Member Premium

(mulai dari hanya Rp 1.650.000/3 bulan!)

30 unggahan bulanan untuk Member Gratis. 9+

pengaturan laporan keuangan agar bisa cocok dengan SAK EMKM (fleksibilitas nama, periode, unduh XLSX/PDF, index catatan laporan keuangan, penandatangan, ubah/tambah instan nama, posisi sub/account, undo, dll.) 10x

lapisan keamanan: autentikasi hash, enkripsi, SSL+HSTS, Cloudflare, CSRF, captcha, firewall, pemisahan arsitektur front-back, proteksi brute force, email alert. <5

menit rata-rata pengguna sudah dapat melihat dan menganalisis hasil jadi laporan keuangannya (output) secara daring maupun dalam bentuk unduhan dokumen XLSX atau PDF yang tersedia bagi Member Premium.

Coba Gratis Sekarang! WhatsApp Plomia

Memproses data_